change in working capital formula excel

A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities. Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

Net Working Capital Formula Calculator Excel Template

This is part of our on-line course Financial Modeling for Business Analysts and Consultants.

. Working capital current assets current liabilities Working capital is important to businesses because changes in working capital can significantly affect cash from operations free cash flow and therefore the value of the business. Methods for Calculating Change in Net Working Capital. NWC Accounts Receivable Inventory Accounts Payable.

Free Cash Flow 15000. The first formula above is the broadest as it includes all accounts and the second formula is the most narrow as it only includes three accounts. Changes in Net Working Capital Formula Working Capital Current Year Working Capital Previous Year.

Hence Free cash flow available to the firm for the calendar year is. Now changes in net working capital are 3000 10000 Less 7000. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million.

We need to calculate Working Capital using Formula ie. The working capital formula is. Net Working Capital Current Assets less cash Current Liabilities less debt or.

Metas resulting working capital is 448 billion. Working Capital Current Assets Current Liabilities. Determine Current Assets from the companys balance sheet for the current and previous period.

Hence the Free Cash Flow for the year is 15000. This working capital Excel template lets you quickly calculate both the working capital and the working capital ratio. Current Ratio and Quick Ratio.

A2 is the cell that contains the lower case information. Now we will see. The networking capital for the year is 5000.

Percent Change New Value Old Value Old Value. Working capital management involves the relationship between a firms short-term assets and its short-term liabilitiesThe goal of working capital management is to ensure that a firm is able to continue its operations and. Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital.

Click here to download the template. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Here we show how to model in Excel the Working Capital.

2016 prior period. Calculate Changes in Net Working Capital using the formula below. When the company finally sells and delivers these products to customers Inventory will go back to 200 and the Change in Working Capital will return to 0.

Now all letters in selected range or entire column are capitalized at once. The easiest way to model working capital is to assume a specific number of days of receivables inventory and payables. Percent Change 3333.

To convert them to upper case find a new column in the spreadsheet and key in the function upper A2. It is a measure of liquidity efficiency and financial health of a company and is calculated using a simple formula current assets accounts receivables cash inventories of unfinished goods. Specify the number of days of receivables inventory and.

Free Cash Flow 50000 30000 5000. Therefore the Change in Working Capital 200 300 100 so its negative and it reduces the companys cash flow. Step 4 Capital Expenditures.

FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10 10 FCFF 18 20 18 10 10. AP accounts payable. In the Change Case dialog box select the UPPER CASE option and then click the OK button.

Working Capital means those liquid funds whether in form of cash deposits in bank or in either way which is kept by an enterprise to manage the day to day running expenses of the business. Percent Change 20000 15000 15000. For the year 2019 the net working capital was 7000 15000 Less 8000.

The same calculation can be done by using excel simple formulas. Current assets include Inventory Receivables prepaid. Working Capital Current Assets Current Liabilities.

The working capital of Meta is calculated by entering the formula B2-B3 into cell B4. Change in working capital Change in Inventory Accounts receivable Accounts payable. You can also convert upper case to lower case using the function lower.

Percent Change 5000 15000. Select the range or entire column you want to capitalize all letters and click Kutools Text Change Case. We love feedback from our customers and.

These assumptions can be derived from historical analysis in the case of an existing projectcompany or by finding comparables for new projects. Thus the formula for changes in non-cash working capital is. For year 2020 the net working capital is 10000 20000 Less 10000.

Change in Net Working Capital Calculation Colgate. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Determine Current Liabilities from the companys balance sheet for the current and previous.

Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable. Change in NWC Formula. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain.

Next enter 532 into cell C2 and 583 into cell C3. Click enter and then copy and paste this formula down. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year.

In this case the change is positive or the current working capital is more than the last year. 2017 current period.

Net Working Capital Template Download Free Excel Template

Top 4 Important Financial Modeling Techniques Simple Educba Financial Modeling Modeling Techniques Finance Investing

Download Employee Absent Rate Calculator Excel Template Exceldatapro Excel Templates Excel Shortcuts Excel

How To Change From Lowercase To Uppercase In Excel 13 Steps Lowercase A Upper Case Create A Timeline

Yield Function Formula Examples Calculate Yield In Excel

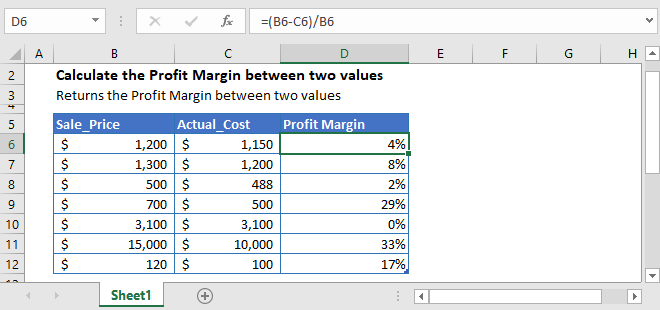

Profit Margin Calculator In Excel Google Sheets Automate Excel

How To Use The Excel Mirr Function Exceljet

Balance Sheet With Working Capital Balance Sheet Template Statement Template Balance Sheet

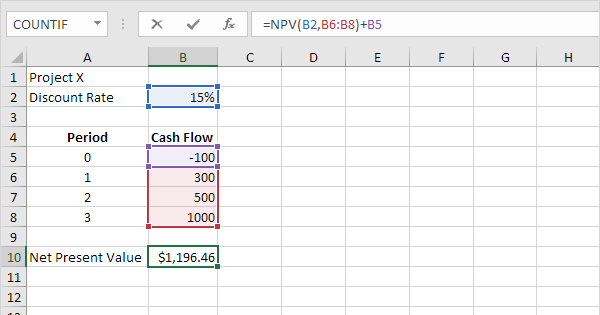

Npv Formula In Excel In Easy Steps

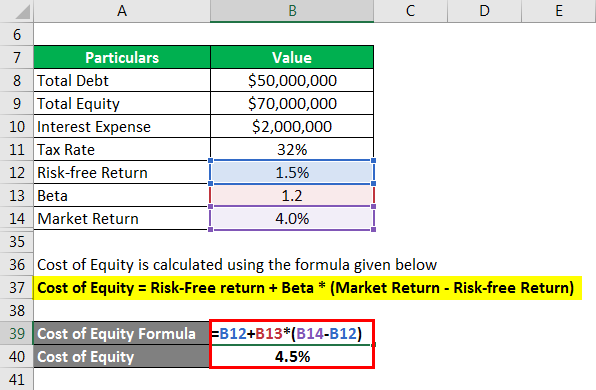

Wacc Formula Calculator Example With Excel Template

Modelling Working Capital Adjustments In Excel Fm

How To Use The Excel Pv Function Exceljet

Change In Net Working Capital Nwc Formula And Calculator

Reorder Point Calculating When To Reorder Tradegecko Safety Stock Point Formula

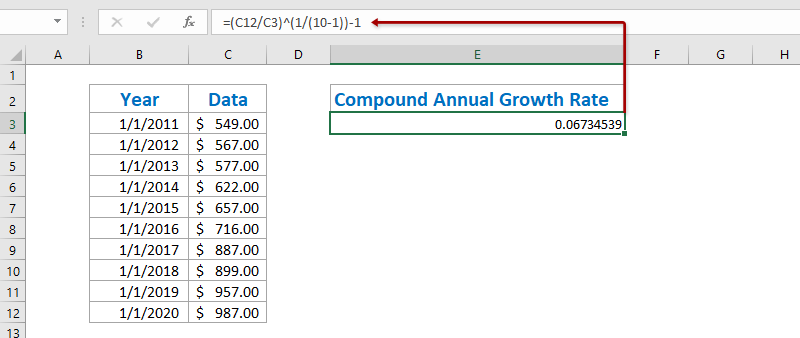

Excel Formula Cagr Formula Examples Exceljet

Net Working Capital Formula Calculator Excel Template

How To Calculate Average Compound Annual Growth Rate In Excel

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

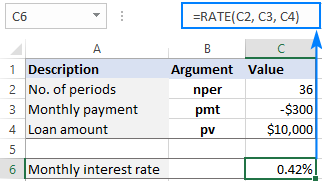

Using Rate Function In Excel To Calculate Interest Rate Ablebits Com